It is almost heretical to question the role of the UK finance industry. Its importance is attested by business leaders, politicians media commentators and, not least, by the industry’s own publicity and lobbying. If you do ask the question, it turns out that there are two quite distinct answers. There exist two separate and incompatible worldviews where finance is concerned, each of which carry very different prescriptions for economic policy.

The first worldview, I will call it the City view, will be familiar to the average, intelligent newspaper readers and to anyone who follows public discourse on economic affairs. The second, which I call the Economy view, is well known to anyone who has studied economic theory at even the simplest level.

The City view sees financial services as one sector of the productive economy, isolated and insulated from the other industries which make up the British economy.Its purpose lies in the contribution it makes to the nations output, as measured by GDP, the jobs it provides in London and around the country and its achievements in exports.

This view has bi-partisan support. The 2024 manifestos of both major parties endorsed the City view. The Conservatives pledged to “support the City of London’s position as the leading global market,” promising polices “so that the UK continues to be the world most innovative and competitive global financial centre.” For emphasis that last bit was printed in bold. Labour’s manifesto was more restrained but still in thrall to the City view. “Financial services are one of Britain’s greatest success stories. Labour will create the conditions to support innovation and growth in the sector

Lobbyists for the City of London have been so successful in promoting this view that the intelligent follower of public discourse is likely to have an exaggerated idea the scale of financial services. With the decline of manufacturing more of the value added in the economy comes from services. As much as four-fifths of GDP can be attributed to services. Finance, however, is only one part of the service sector. According to the office of national statistics financial services contribute 9% of GDP and the sector has 1.5 million employees, which is 4.5% of the UK workforce. Global trade is dominated by trade in goods and despite being a service economy, UK exports are fairly evenly split between goods and services. Financial service account for around 10% of total exports.

The alternative worldview understands that a well functioning finance sector is an essential to the health of the economy of which it is an integral part. The Economy view begins from a simple model of banking. Banks adsorb the savings of those who do not want to use all of their income and provide loans to those whose projects cannot be funded from their income. So, if households do not want to consume all of their income the finance sector provides mechanisms to ensure that companies have the resources they need for investment.

Not just banks but other financial institutions, like insurance companies and mutual funds, collect money and hold pools of funds available for investment.

The second function of banks derives from the fact that savers mostly want easy access to their accounts while investment requires long term funding. On one side of a banks balance sheet are sort term savings and on the other long term loans. In effect banks convert short term monies into long term monies. This is known as “liquidity transformation” as “liquid” savings back “illiquid” loans.

Again, it is not just banks that perform this transformation. For example companies borrow money by selling bonds which have a term of several years. However, the bond market allows bond-holders to exchange their bonds for cash at any time. Long term investment can be funded by bonds which are easily converted to cash.

Finally, Banks create money in the form of credit. An old economic textbook would say that banks lend out money which has been deposited. However, when a bank makes a loan it deposits money in the borrower account. Now it can make new loans with that deposit. Credit creates new money. Modern textbooks offer a simpler explanation, where by making a loan and depositing it with the borrower’s account, it has created the money in a single step.

All of these processes — mobilising resources for investment, enabling long term investment and creating credit money — have a single economic purpose, namely, to provide finance for investment. More broadly, the Economy view sees the role of finance as the effective allocation of capital to the most promising projects. This worldview understands the value of the finance sector in terms of how well it performs the function of channelling finance to investment.The economic benefit of financial services lies in the wealth creation that flows from investment in productive activities.

The differences between these two worldviews are profound. The City view sees financial services as an island in the economic sea; the Economy view sees the finance sector as embedded in the structure of the production of goods and services. The City view measures the contribution of finance in terms of internal metrics of total activity, jobs and sales. The Economy view judges finance by how well it functions to allocate capital I support of the national economy.

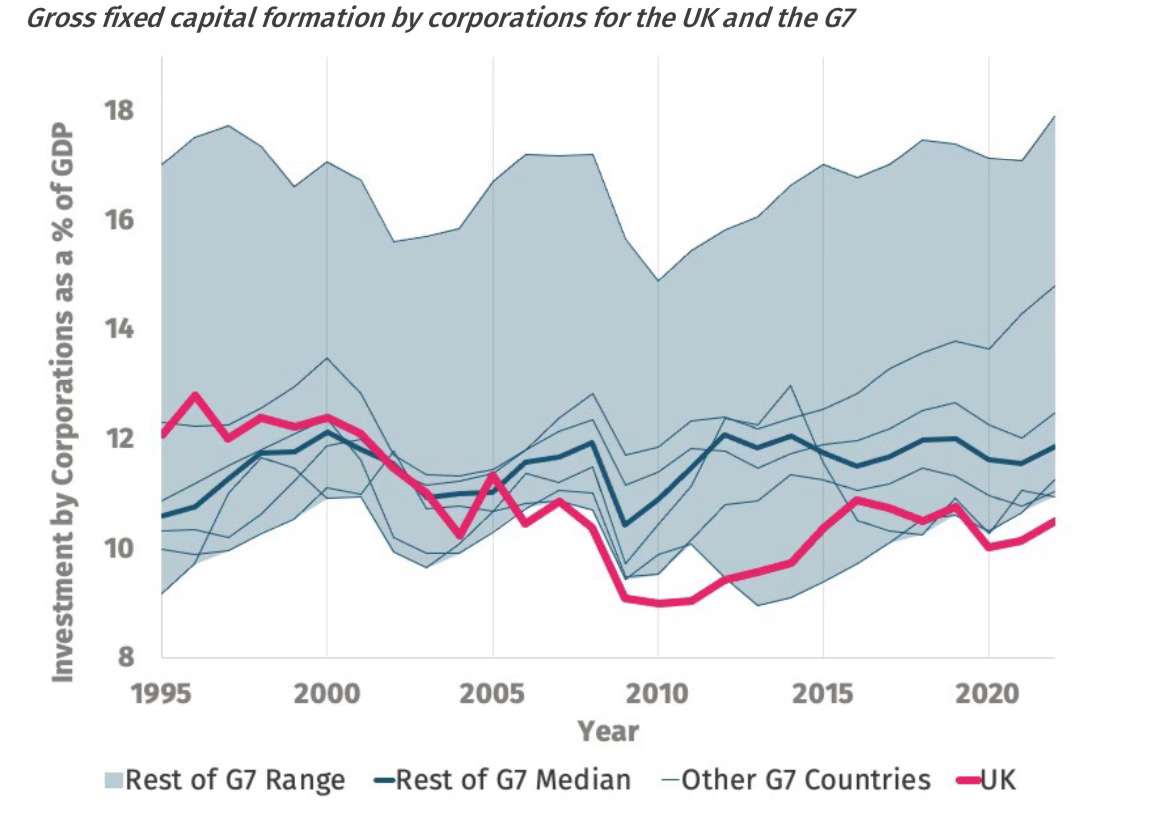

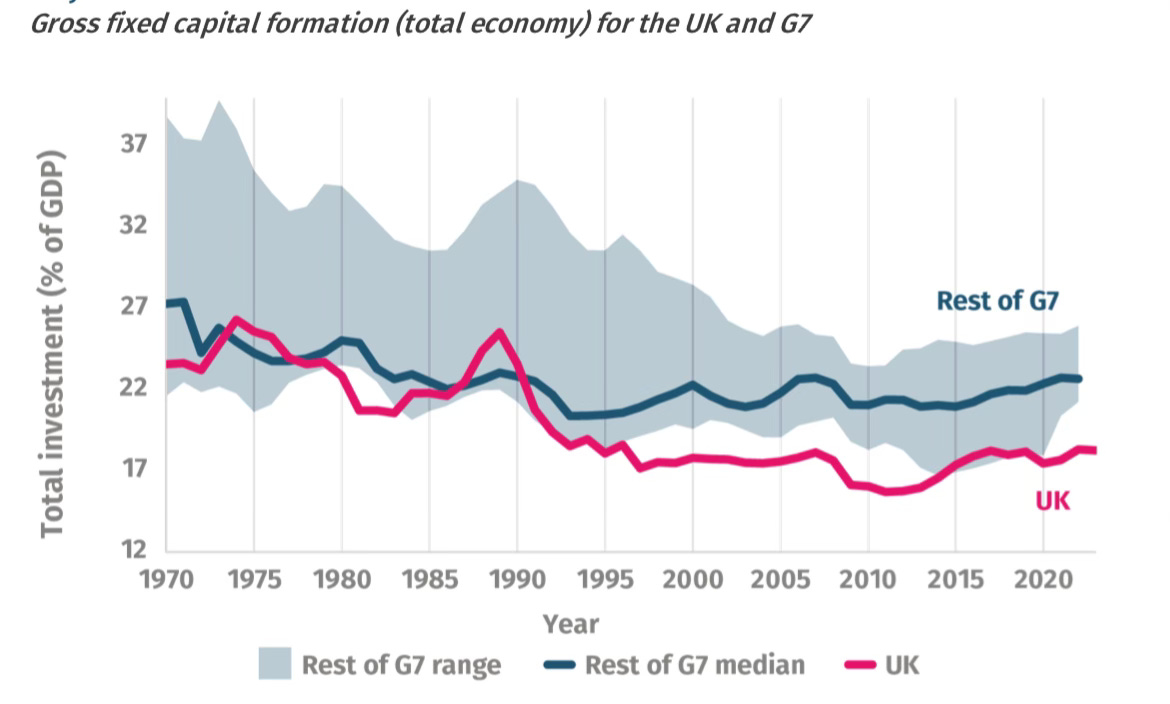

While the City view hails Britain’s finical services as a great success, the Economy view raises difficult questions. Most economists agree that the UK economy is held back by a lack of investment. Total investment and business investment in Britain has lagged behind its peers. The charts below, from a recent report by IPPR, uses OECD data to compare investment levels in G7 countries.

We are faced with a paradox: Britain has a globally important financial sector but an abysmal record of investment.